Nintendo, the business, has actually been around since the 1880s. They sold playing cards for a while and there are lots of resources online about its history. But Nintendo, the video game company, was born in the 1980s and became synonymous with video games, especially for millennials. But what interested me in the stock was how fixated my toddler son became with Mario, Nintendo’s flagship mascot. At that time, he didn’t even know what a video game was. Rather, it was a combination of me winning a Mario plush at a county fair, and the Super Mario Bros. Movie, that introduced him to the iconic plumber. It was how this connection formed, between my 2-year-old and a plumber character from the 1980s, that piqued my interest in the business.

I began to DCA into $NTDOY in 2023. Since then, the stock is up over 100% while Nintendo is about to release its biggest launch ever. Because of this, I wanted to deep dive into their business to better understand this investment. Today, Nintendo is trading at all-time highs, yet I believe they are just beginning to hit an S-curve of growth.

Section 1: Investment Thesis Summary

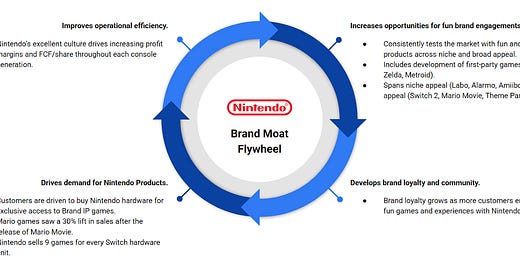

Nintendo is an extraordinary company that is set to dominate the console gaming market throughout the rest of the decade. Their business operates as a flywheel, a self-reinforcing loop of customer interactions that leads to sustained growth and momentum across the business. Nintendo’s flywheel draws customers into their ecosystem and continuously converts them across a library of products. They steward some of the world’s most valuable IP, including Mario, Zelda, and Pokemon, which funnels customers into fun and unique experiences across their gaming hardware platform. Their games deepen the relationship between customers and their brand IP, which drives demand for more brand experiences. Meeting this demand consistently grows profit margins and free cash flow per share, which funds further research and development for new hardware, software, and other fun and unique experiences to offer.

Section 2: The Nintendo Flywheel: Core Value Creation Mechanisms

2.1 The Integrated Ecosystem: Switch Hardware, First-Party Software, and IP Dominance

Nintendo's position in home entertainment stems from three interconnected elements that play into each other. With control over hardware development, game design, and management of globally recognized IP, Nintendo provides customers with an ecosystem that’s unmatched by competitors. Together, these three elements form the foundation of Nintendo's flywheel, strengthening its moat, or long term competitive advantage, with each customer engagement.

The core of Nintendo's competitive advantage lies in its intellectual property. Characters like Mario, Link, and Pikachu are globally recognized and beloved, creating deep emotional connections with consumers that are transcending generations. As interest in these IP leads customers toward buying hardware and games, their relationship with the IP grows stronger. This leads to more game purchases and eventually to the purchase of additional hardware, serving as both a significant growth driver and a reinforcing mechanism for the entire Nintendo flywheel.

Hardware serves as their primary point of engagement with customers. The Nintendo Switch, having shipped over 150 million units worldwide, established a massive and engaged installed base who are ready for the next generation of hardware, the Switch 2. Early figures on Switch 2 pre-orders signal record-breaking demand, tallying 2.2 million pre-orders in Japan alone. For context, the current Switch and the Playstation 2 are the best selling consoles of all time, and they respectively sold 330k and 630k units at launch.

What drives the adoption of Nintendo hardware and fosters long-term player engagement are their first-party titles. Iconic IP franchises such as Mario, The Legend of Zelda, and Pokémon are not just games; they are cultural touchstones that consistently draw players into the Nintendo ecosystem. These titles demonstrate remarkable commercial longevity, often referred to as "evergreen" sellers, maintaining strong sales years after their initial release. Mario Kart 8 Deluxe, for instance, has sold an astonishing 67.35 million copies. This software prowess translates directly into financial strength; Nintendo generates significantly higher revenue from its first-party software compared to competitors Sony and Microsoft, underscoring the critical role of its first party titles. The continued success of recent major releases, such as The Legend of Zelda: Tears of the Kingdom (21.55 million units) and Super Mario Bros. Wonder (15.51 million units), confirms the enduring appeal and commercial power of these core franchises.

Taken together, these elements create a multi-layered competitive moat that extends beyond any single factor. It is the interplay between the trusted brand, the unique hardware/software ecosystem, and the unparalleled strength of its IP that grants Nintendo its enduring market power and profitability potential. And as we’ll soon find out, it’s Nintendo’s commitment to differentiated experiences that drives this all forward.

2.2 Quantifying the Flywheel: Key Performance Indicators (KPIs)

There are plenty of obvious KPIs to track for Nintendo which I won’t dive too deeply into. Sales (total and by geography) offers a rear view of Nintendo’s overall performance. Mobile & IP Related Revenue is a much smaller contributor to the bottom line, but its growth measures the overall brand strength that feeds Nintendo’s flywheel. For example, this KPI includes revenue from The Super Mario Bros. Movie, the 2nd highest grossing film of 2023. More importantly, the movie demonstrated a significant "halo effect," measurably boosting sales of Mario-related Switch games by 1.3x over subsequent quarters.

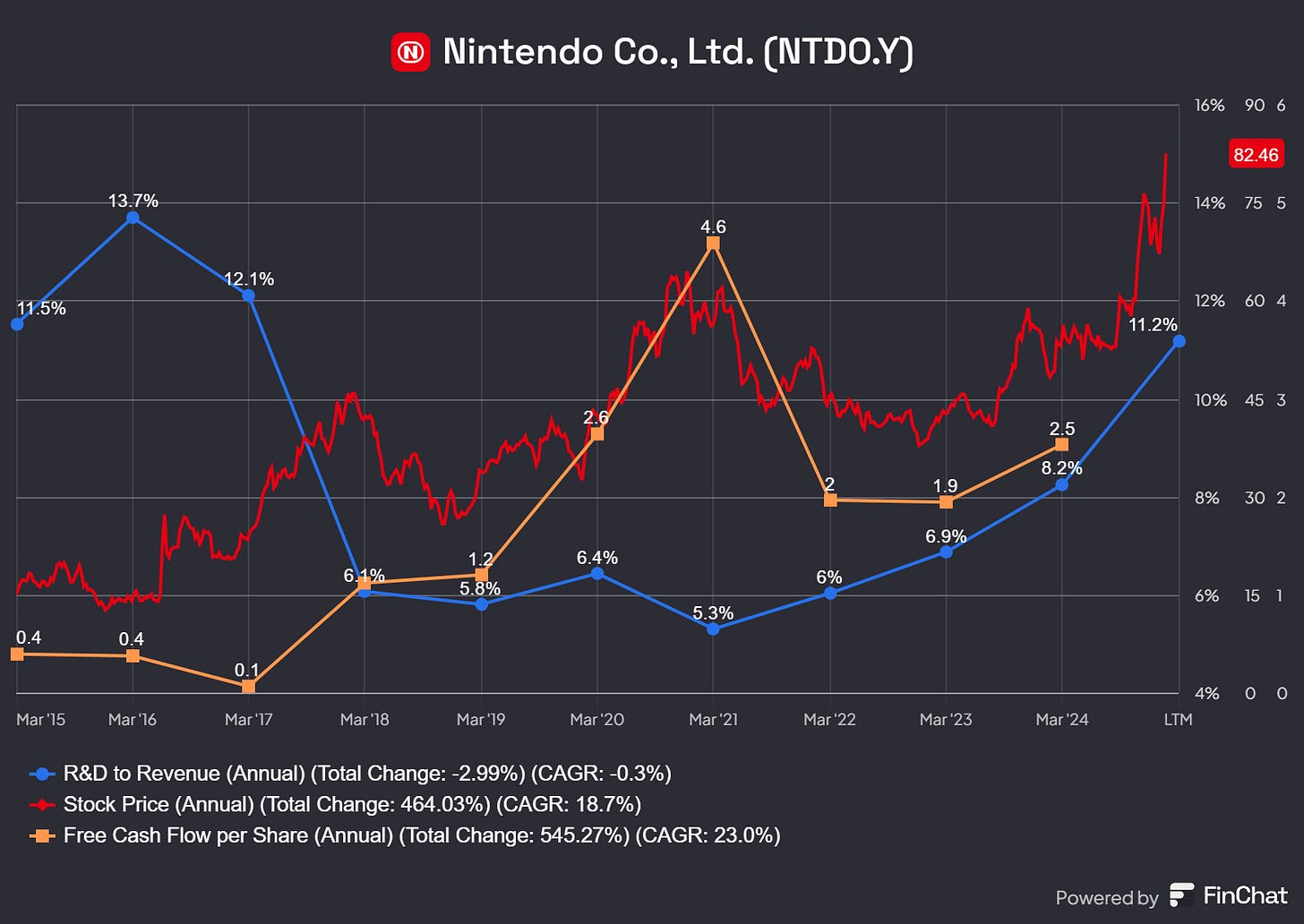

Nintendo’s R&D to Revenue acts as a predictive KPI for an increase in stock price. For Nintendo, revenue typically cycles into a peak 3-5 years after launching a hardware platform. While revenue subsequently declines, Nintendo invests more heavily into their next hardware platform, as indicated by their increase in R&D to Revenue. This measure peaks at the launch of a new hardware generation, then declines steeply, and is followed by periods of increasing Free Cash Flow per Share and stock price. I expect this figure to sharply decline over the next 4 quarters.

Of course there is risk in trusting this measure alone for prediction. If Nintendo launched a hardware generation that fails to become a hit, as it did with the Wii U in 2012, the boon to FCF/Share will be dampened. But the risk of a Switch 2 flop is looking less likely every day, as pre-orders are at record breaking levels, and preview reception has been very positive. Regardless, I believe that Nintendo has managerial, operational, and structural traits to succeed through unforeseen challenges. Their $10b cash position shows that they have learned from past mistakes, with reserves to weather storms. More importantly, they have put themselves into a position that will take increasing market share throughout the rest of the decade, increasing FCF/Share in turn.

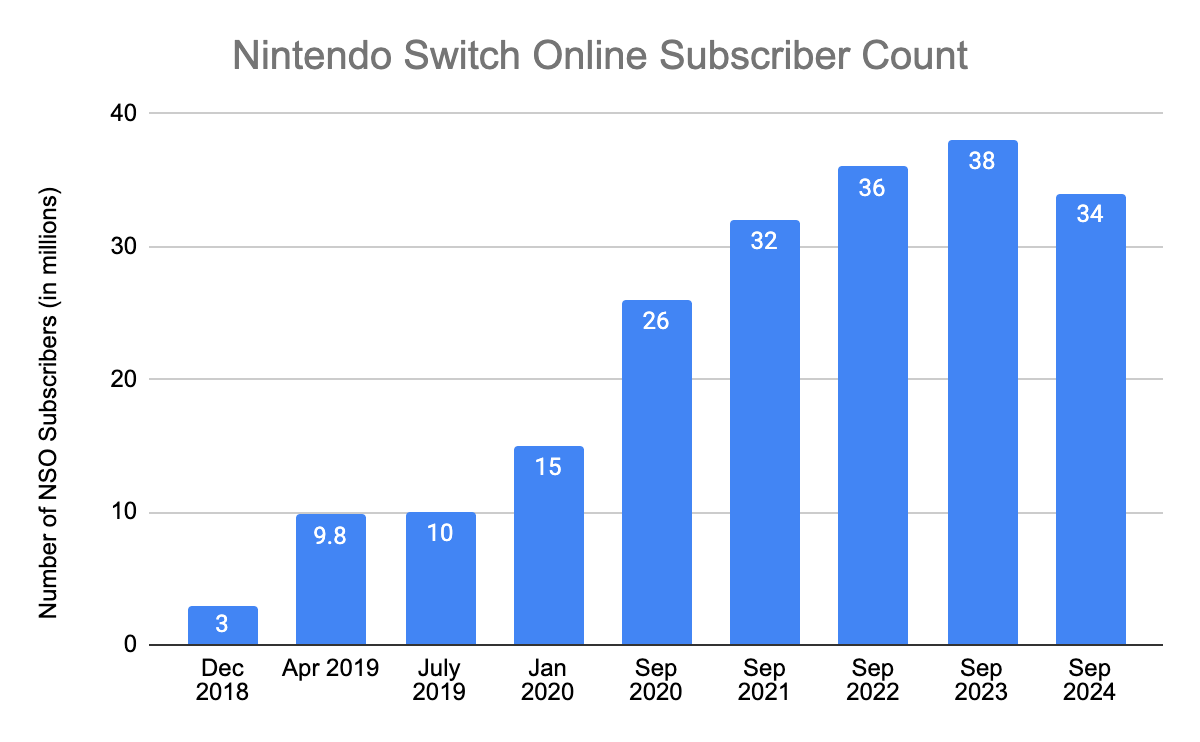

At deeper levels, I believe that customer stickiness is what keeps the brand flywheel flowing. Nintendo Switch Online (NSO) Subscriptions not only provides a source of recurring revenue, but also indicates deepening player investment in the platform. These are Nintendo’s highest value customers, who pay subscription fees on top of buying games and leveraging online services. Today, Nintendo’s 34 million NSO subscribers are deep in the flywheel, and are very likely to engage with Nintendo in numerous ways. Growth in this figure has been stagnant over the past few quarters, and I’ll be closely monitoring this in the next earnings reports as the Switch 2 installed base grows.

Ultimately, I believe Nintendo’s Software to Hardware Sales ratio is the ultimate measure of customer stickiness, and therefore the ultimate KPI for Nintendo’s fundamental performance. The Switch sells 9.01 games for each hardware unit. Steady growth of this ratio illustrates the steady growth in value that Nintendo continuously delivers to customers. This ratio will get interesting when backwards compatibility is taken into account for the Switch 2. Of Nintendo’s 10 other major hardware platforms, only 2 achieved a Software to Hardware to Sales ratio > 9, the Wii and the Gamecube.

2.3 Drivers of Operating Leverage: Internal Culture, Development Philosophy, and Cost Management

Nintendo's potential for operating leverage – the ability to grow profits at a faster rate than revenue – is intrinsically linked to its unique internal operations and development culture.

The company's development philosophy, shaped by beloved execs like Shigeru Miyamoto and Gunpei Yokoi, prioritizes creating unique, engaging gameplay experiences – "fun" – over simply pushing the boundaries of graphical fidelity. Yokoi's concept of "Lateral Thinking with Withered Technology" (using mature, affordable technology in novel ways), allows Nintendo to differentiate its products while contributing to a more controlled cost structure for hardware and first-party software development. Nintendo leadership explicitly reinforces this, stating that unique creativity is paramount and that large budgets are not always necessary to create appealing products. Meanwhile, competitors are engaged in a technological arms race where advanced-art-asset (AAA) game budgets frequently exceed $100 million and can reach $300-500 million.

A core tenet of this philosophy is a relentless pursuit of innovation, not just for technology's sake, but to enable new forms of play. Leadership emphasizes the importance of creating "something which has not existed in the past" and demonstrates a willingness to deviate from industry trends if they don't align with Nintendo's vision. This mindset has historically driven groundbreaking hardware innovations – from the D-Pad and analog stick to motion controls and the Switch's hybrid concept – as well as unique software and game design paradigms.

This philosophy further permeates the internal teams, particularly Nintendo Entertainment Planning & Development (EPD), the division responsible for most first-party hits. These teams possess deep familiarity with Nintendo's hardware capabilities and IP, fostering efficiency and maintaining a high standard of polish and quality control. As another example, Nintendo merged its formerly separate handheld and home console development divisions ahead of the 2017 Switch launch, which has not only further streamlined operations and created lasting efficiencies, but has also resulted in an output of one first-party title release per month. This allows Nintendo to both prove out unique game designs, and to offer its customers with new brand engagements.

Their combination of a more cost-effective development approach in tandem with hyper focus on developing creative and fun experiences creates fertile ground for operating leverage, increasing margins along with the perceived value of their products. Operational leverage is further gained as Nintendo increases its proportion of high-margin digital sales, grows its library of 3rd party titles, and expands IP offerings, all of which contribute to disproportionately higher profit growth.

2.4 Catalyst for Growth: The Switch 2 Opportunity

The launch of the Nintendo Switch 2, on June 5, 2025, represents Nintendo’s biggest growth catalyst yet. This hardware refresh introduces substantial improvements designed to enhance the gaming experience and broaden the platform's capabilities.

Crucially, the Switch 2 will feature backwards compatibility, allowing users to play a vast library of existing Nintendo Switch physical and digital games on the new hardware. This leverages the enormous existing Switch software library and provides a seamless transition path for the over 100 million active Switch users, each of whom own 9 titles on average that will work on the new hardware. It significantly de-risks the Switch 2 launch by mitigating the software scarcity often associated with new console debuts and maintaining player engagement within the Nintendo ecosystem from day one.

Additionally, the enhanced processing power of the Switch 2 also makes it a more attractive platform for third-party developers, addressing a historical limitation of Nintendo consoles. Nintendo appears to be capitalizing on this, actively courting external studios and even acquiring Shiver Entertainment, a developer specializing in porting games, to facilitate this process. The result is a confirmed lineup of over 46 third-party titles for the Switch 2, including major multiplatform franchises like Final Fantasy VII Remake Intergrade, Cyberpunk 2077: Ultimate Edition, and annual sports titles from EA, as well as exclusive titles like FromSoftware’s The Duskbloods. I believe this strengthened third-party support, enabled by the more capable hardware, has the potential to significantly broaden the Switch 2's appeal beyond Nintendo's traditional audience, capturing players who might otherwise gravitate toward PlayStation, Xbox, or Steam Deck platforms which historically offered wider third-party libraries.

From a revenue perspective, the Switch 2 launch is poised to drive substantial hardware sales, with analysts forecasting 13-15 million units in calendar year 2025. New software features like GameChat and GameShare aim to boost online interaction and potentially drive NSO subscription uptake. Furthermore, Nintendo is introducing higher price points for its flagship software, with its Mario Kart World launch title priced at $79.99. While controversial, if accepted by consumers, this could significantly increase average revenue per software unit sold.

2.5 Expanding the Universe: IP Monetization Beyond Gaming

Parallel to its core gaming business, Nintendo is expanding the reach and monetization of its valuable IP into adjacent entertainment sectors, transforming itself into a broader entertainment company that could be on a collision course with Disney over the next 10 years. These initiatives create new, high-margin revenue streams that reduce the company's historical dependence on the cyclical console market. More importantly, these initiatives also act as powerful marketing vehicles, driving awareness and engagement back towards the core gaming ecosystem and feeding the flywheel.

These initiatives include Theme Parks in collaboration with Universal Studios, and movies like Super Mario Bros. Movie (2023), it’s upcoming 2026 sequel, and an announced The Legend of Zelda movie. Nintendo also generates revenue through licensing its characters and brands for use in various consumer products, including toys (via partnerships with companies like Hasbro and Mattel), apparel (collaborations with Levi's, Puma), and other categories. This represents a relatively high-margin revenue stream.

But the true value of IP expansion goes beyond high-margin revenue streams. They function as both a top-of-funnel driver and a reinforcing mechanism to Nintendo’s flywheel: the popularity of games fuels demand for related entertainment experiences and merchandise, while the success and visibility of these external ventures drive new and existing consumers back to the core gaming platform. This synergy drives momentum throughout the entire business, deepening the brand moat and increasing customer lifetime value.

Section 3: Organizational Strength and Competitive Positioning

3.1 Management Philosophy and Culture: The "Fun" Factor as a Strategic Asset

Nintendo's enduring success can be attributed to their unique corporate culture and management philosophy. They prioritize creativity, innovation, and player enjoyment above all else. As mentioned in 2.3, this ethos is critical for driving Nintendo’s operating leverage and product development, and naturally, this culture also extends to talent management.

The company actively seeks to nurture developers who understand and embrace this unique approach to game design. Miyamoto himself speaks of mentoring designers not just to iterate on existing game formulas, but to observe the world around them and translate those observations into novel interactive experiences. Collaboration across different disciplines is also encouraged to foster creative solutions.

Furthermore, Nintendo generally adopts a long-term perspective, focusing on building enduring relationships between players and its intellectual properties, often avoiding the aggressive short-term monetization tactics that are sometimes employed by competitors, like pervasive microtransactions in premium games. This deeply ingrained culture, centered on delivering unique fun and fostering innovation, functions as a core strategic asset. It directly informs product development decisions, influences cost management strategies, and ultimately underpins the company's enduring brand appeal and significant competitive differentiation.

3.2 Operational Excellence: Resilience, Profitability, and Prudent Capital Management

Nintendo's unique culture is complemented by a track record of operational excellence and financial prudence, contributing significantly to its stability and resilience.

The company has demonstrated a remarkable ability to maintain profitability, even during challenging hardware cycles. The Wii U era, for example, saw significantly disappointing hardware sales, leading to annual operating losses in some periods. However, Nintendo navigated this difficult period while keeping gross profit margins positive. They were able to maintain other product lines like the Nintendo 3DS and drove resilient software sales even on the struggling Wii U platform, where some titles still surpassed 1 million units sold. This performance highlights effective cost control mechanisms and the high intrinsic profitability of its software and IP.

This resilience is also reflected in its approach to human capital. During the widespread video game industry layoffs of 2023-2025, which saw thousands of job cuts across major publishers and developers, Nintendo notably avoided comparable mass layoffs of its full-time workforce. In another example, former CEO Satoru Iwata famously cut his own salary in half when previous hardware failed to meet sales expectations. The company's overall approach suggests a management philosophy that prioritizes long-term stability and talent retention over reactive, short-term cost-cutting.

Underpinning this operational stability is an exceptionally strong balance sheet characterized by zero debt and the accumulation of substantial cash reserves. As of March 31, 2024, the company held over $10b in cash, deposits, and securities. This massive financial cushion provides Nintendo with immense strategic flexibility. It allows the company to comfortably fund long-term, ambitious R&D projects for future hardware and software, easily weather market downturns or hardware missteps, pursue strategic acquisitions, and finance its expansion into new areas like theme parks and movies.

3.3 Competitive Positioning: Nintendo vs. The Competition (Sony PlayStation, Microsoft Xbox, Valve Steam Deck)

Nintendo operates within a highly competitive video game market, but is often left out of the conversation as it blazes its own trail. For example, the Sony Playstation and Microsoft Xbox are often grouped together in competition, as they both focus on high-end hardware and their last 2 generations launched within months of each other. Conversely, Nintendo launched the Switch 3 years before Sony and Microsoft’s latest consoles, eschewing the competition for its own timeline.

Nintendo's focus on gameplay innovation over graphical parity, combined with its development philosophy, likely results in comparatively lower development costs for its first-party titles. This, coupled with strong software sales, contributes to Nintendo consistently reporting higher first-party publishing revenue and higher overall profit margins than its competitors. Sony, conversely, faces significant pressure from the ballooning costs of AAA game development, which has contributed to relatively thin operating profit margins within its Game & Network Services segment despite high revenues.

This comparative analysis underscores that Nintendo is not attempting to win by imitating its competitors. Its differentiated strategy, built on unique integrated experiences and powerful IP, allows it to cultivate a massive, loyal audience and achieve robust profitability without necessarily leading in raw hardware power or overall market revenue.

I believe that a third competitor, Valve’s Steam Deck, is on a more direct collision course with Nintendo. Valve owns the vast majority of distribution for games on the PC, and its first party titles are some of the most played in the world (Counterstrike, Dota 2). Their portable gaming PC, Steam Deck, has a design that’s loosely inspired by the Nintendo Switch, and offers access to the mega expansive library of Steam’s PC games (>100k games are on Steam, <15k games are on the Switch). Virtually all PC games, including ports from Playstation and Xbox, can be played on Steam. But while Nintendo’s Switch 2 will garner a larger share of these 3rd party releases that are also found on Steam, Nintendo’s hardware is the only place to access its iconic brand games, which is a core driver for Nintendo’s hardware sales. Currently, Steam Deck sales currently pale in comparison to the Switch’s (4m to 150m+) so I’m very interested to see how Valve continues to support and grow this platform.

Section 4: Risk Assessment

Despite its strengths, Nintendo faces several potential pitfalls and risks that warrant careful consideration.

Navigating the Transition: Switch 2 Execution Risks: The upcoming launch of the Switch 2, while a major opportunity, carries significant execution risks, primarily centered around its pricing and communication strategy.

Pricing Controversy: The announced price points - $449.99 for the base console and a striking $79.99 for the flagship launch title Mario Kart World - represent a substantial increase over the original Switch and the current $70 standard for AAA games on competing platforms. This has generated considerable consumer backlash and concern ("uproar"). Nintendo justifies the pricing based on the value delivered and rising development costs, and analysts suggest the company believes its strong brand and initial target market of enthusiasts will tolerate these prices. Nevertheless, this strategy risks alienating a portion of the potential install base and could dampen adoption beyond the initial launch wave.

Communication & Tariffs: Nintendo's initial handling of the price announcement was hesitant, omitting it from the main reveal presentation. Compounding this is the significant uncertainty surrounding potential US tariffs on goods manufactured in China, where the Switch 2 is likely assembled. This led to speculation about further price hikes and resulted in Nintendo delaying the opening of pre-orders in the US and Canada. While Nintendo stated the initial $449 price did not factor in tariffs, and some analysts later tempered expectations of immediate, drastic increases, the lack of clarity and the potential for external economic factors to force price adjustments create significant launch risk. Effectively communicating the value proposition and navigating the tariff situation will be critical to the Switch 2's success. Pushing prices significantly higher tests the limits of brand loyalty and could impede the smooth functioning of the value-creation flywheel.

Leadership and Succession Planning: Nintendo benefits from experienced and visionary leadership, with President Shuntaro Furukawa, 53, and Executive Fellow Shigeru Miyamoto, 72, actively guiding strategy. Miyamoto, in particular, remains a towering figure whose creative philosophy continues to permeate the company's approach to game design. Leadership emphasizes the importance of mentoring the next generation of developers and producers to carry forward the Nintendo way. However, the long tenure of key figures like Miyamoto inevitably raises questions about long-term succession planning. The great news is Nintendo has began featuring younger execs in more promotional videos, such as Kouichi Kawamoto (Switch 2 Producer), Takuhiro Dohta (Switch 2 Director), and Tetsuya Sasaki (Switch 2 Technical Director).

AI Utilization: This is less of a risk, and more of an unknown. Nintendo has hinted that their unique approach to development will extend to having a unique approach to AI. But without any specifics, it’s hard to imagine how this kind of approach would materialize. Given their vast amounts of first party data, I’m curious to see how they leverage AI to deliver results to the business.

Section 5: Nintendo’s Fundamentals

Nintendo’s combination of their beloved brands, unique hardware, and fun games create a flywheel business that continuously grows and strengthens its own moat. But what really drives the business are Nintendo’s organizational traits: their leadership, culture, and processes have often revolutionized the gaming industry, through successes and failures, over the last 4 decades. I believe these are the fundamental qualities of Nintendo that created such a sticky customer base with their Switch platform. Looking forward, I believe these fundamentals will only improve with the Switch 2, and I’m excited to track performance moving forward.